A Simplified Balanced ‘Balanced Scorecard’

Author

Ivan Malbasic – (University of Zagreb)

Frederic Marimon – (Universitat Internacional de Catalunya)

Abstract

This paper proposes a performance measurement system (PMS) based on the Balanced Scorecard (BSC) that requires only 25 common key performance indictors (KPIs), which are characterized by their easiness to collect, in turn making the PMS an affordable instrument for all types of organizations, regardless of their resource availability. This is particularly relevant for SMEs. A sample of 813 surveys collected from managers in the Republic of Croatia is analyzed through structural equation modeling. The proposed simplified BSC shows good psychometric features, and the relationships found among the four classical perspectives are consistent with the literature, which provides homological validity for the model. This paper also proves that the equilibrium among the four perspectives has a significant impact on three perspectives, vouching for the importance of this balance among perspectives. It further shows the extent to which strategy influences the four perspectives. The proposed simplified BSC may interest both academics and practitioners as it does not require any special knowledge or additional resources to be implemented and monitored while also highlighting (i) the importance of strategy in the design of the model (ii) and the importance of balance among perspectives.

Keywords

- Balanced scorecard

- Performance measurement system

- Small and medium-sized enterprises

- Key performance indicators

1. Introduction

Kaplan and Norton (1996) introduced the Balanced Scorecard (BSC) at the end of the 20th century as an instrument to measure an organization’s performance and, at the same time, as a way to deploy its strategy. Since then, many organizations have applied and used it (Hoque 2014). The success of this particular performance measurement system (PMS) has been extensively analyzed. Different organizations have different motives for using it (e.g., Rodrigues Quesado et al. (2017) adapts it to non-profit organizations). Lueg and Carvalho e Silva (2013) analyzes how BSC has been modified to match different industries and organizational levels. Consequently, each organization ‘customizes’ the model to pursue its particular aims. Some organizations use mainly financial indicators and only a few non-financial indicators, whereas others use indicators from the four key business perspectives—financial, customers, internal business processes, and learning and growth. PMSs have evolved from having a purely financial perspective to having a more strategic outlook (Hurtado González et al. 2012).

Kaplan and Norton (1996) claim that all business perspectives are useful and necessary to measure organizational performance and assess its evolution over time. This approach also enables the introduction of innovations that guarantee overall improvement and provides material for effective benchmarking. It requires each organization to collect its own key performance indicators (KPIs) depending on available resources, sectors of activity and other relevant factors (Kasurinen 2002). Small and medium enterprises (SME) in particular devote few resources to designing a PMS and collecting information to feed the system.

To provide a consistent and effective PMS for SMEs, this paper proposes a system based on the BSC that requires few KPIs to minimize implementation and monitoring costs. Hence, these KPIs are easy to collect and monitor while remaining universal, thus enabling benchmarking among these organizations. Kaplan and Norton (1996) state, furthermore, that the four aforementioned perspectives are required and that a harmonic balance among them through time helps an organization to excel. These considerations introduce two new central issues as follows: (i) to what extent does strategy definition affect the four original perspectives and (ii) to what extent does the degree of balance among the four perspectives of a BSC impact these perspectives as well as strategy deployment?

The purpose of this paper is thus twofold. The first is to propose a simple and universal PMS based on BSC that takes into account all four perspectives and that can be used by any SME. Because this instrument is based on BSC, the second objective of this paper has three components as follows: (i) verifying whether the perspectives of the proposed PMS affect one another as expected and providing evidence for its homological validity, (ii) analyzing the impact of strategy on the four perspectives and (iii) analyzing to what extent the degree of balance among perspectives impacts these four perspectives and strategy deployment.

Thus, fresh view on the causal-effect between perspectives will be provided, and the original contribution is the analysis the impact of both (i) strategy and (ii) balance among perspectives on the four BSC perspectives. On the other hand, all this new approach is useful for SME, which due to different motivations prefer using a simple and reduced BSC, composed for few KPIs that can be collected easily.

The rest of the paper is structured as follows. A literature review is provided in section two along with justification of the hypotheses. In the third section, we provide an extended explanation of the balanced BSC proposed. Section four describes the methodology and results. Finally, the fifth section provides the discussion and conclusions, including some study limitations.

2. Literature review and hypotheses

2.1. The Balanced Scorecard

Kaplan and Norton (1992, 1996) developed the most widely used model for measuring organizational effectiveness. Amado et al. (2012) particularly analyze the impact of the BSC use on the organization effectiveness. This model contains not only traditional financial performance measures focused on the past but also indicators that initiate future actions in the organization (Kaplan and Norton 1996; Wade and Recardo 2001; Celma et al. 2017), taking into account four business perspectives (Kaplan and Norton 1996; Kumbakara 2008). The relationship among BSC measures is described in Kaplan and Norton (1996), in both text and figures. It assumes a causal relationship between the learning and growth perspective and the financial perspective, mediated by the other two perspectives, customers and internal business practices (Kaplan and Norton 1996, pp. 3, 72, 111, 113, 129, 152 and 160). Some studies analyze the cause-and-effect chain among the perspectives of the BSC empirically. Nørreklit (2000), for instance, examines the extent to which such cause-and-effect relationships exist among the four BSC perspectives, whereas Bryant et al. (2004) use cross-sectional data on seven archival measures of the BSC perspectives. Moreover, analyzing the concept of BSC, Čizmić and Crnkić (2010) show an even stronger connection between key perspectives of the BSC. According to them, the BSC is designed as a series of causal relationships, both within and between perspectives, resulting in achievement of financial objectives.

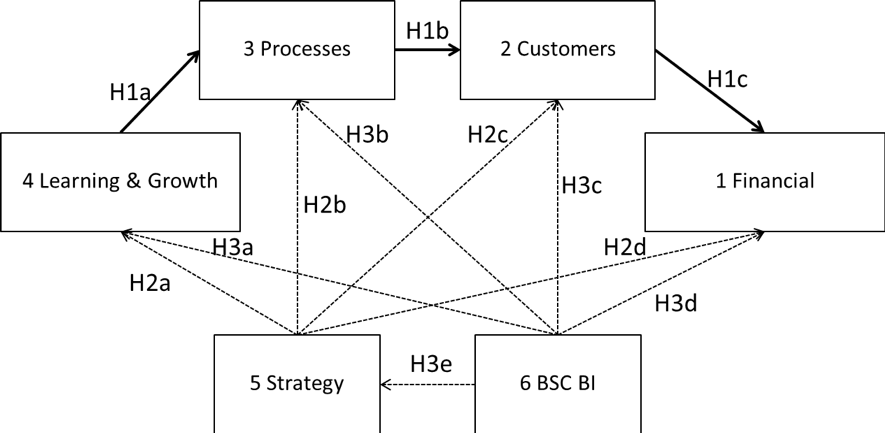

Based on the causality implicit in the model, three sub-hypotheses are stated (based on Epstein and Manzoni 1997; Martinsons et al. 1999; Mooraj et al. 1999; Atkinson 2006; Carton and Hofer 2006):

H1a: Higher levels of ‘learning and growth’ perspective are positively related to higher levels of ‘internal business processes’ perspective.

H1b: Higher levels of ‘internal business processes’ perspective are positively related to higher levels of ‘customers’ perspective.

H1c: Higher levels of ‘customers’ perspective are positively related to higher levels of ‘financial’ perspective.

The hypothesis underlying these three sub-hypotheses is that the proposed balanced BSC behaves in the same way as the original BSC.

2.2. The impact of strategy on the four perspectives

The BSC was initially established to cover four key business perspectives. However, Kaplan and Norton indicated that it is necessary to link BSC measures with company strategy, stating that “a successful Balanced Scorecard is one that communicates a strategy through an integrated set of financial and nonfinancial measurements” (1996, p. 147). In considering specific situations for using BSC, such as applications in small enterprises and in the public sector, some authors suggest it is useful to explicitly include indicators of a more general, or strategic, perspective to connect all the other perspectives (Morisawa and Kurosaki 2003; Bryant et al. 2004; Moullin 2004; Atkinson 2006; Huang et al. 2009; Parmenter 2010; Janeš 2014). This strategic perspective could supplement other perspectives, giving the overall PMS a note of company personality.

As one of the purposes of the BSC is to assist with strategy implementation, Kaplan and Norton (1996) argue that its metrics must measure those activities that lead to strategy implementation. Consequently, both Nanni et al. (1992) and Atkinson (2006) state that an integrated PMS has to be aligned with company strategy. Given that a good BSC should be customized based on a company’s business strategy, four sub-hypotheses are proposed to test the relationship between strategy implementation and each of the four original BSC perspectives:

H2a: Higher levels of ‘strategy implementation’ are positively related to higher levels of ‘learning and growth’ perspective.

H2b: Higher levels of ‘strategy implementation’ are positively related to higher levels of ‘internal business processes’ perspective.

H2c: Higher levels of ‘strategy implementation’ are positively related to higher levels of ‘customers’ perspective.

H2d: Higher levels of ‘strategy implementation’ are positively related to higher levels of ‘financial’ perspective.

2.3. Equilibrium among perspectives

The essence of the BSC concept reflects the balance “between short- and long-term objectives, between financial and nonfinancial measures, between lagging and leading indicators, and between external and internal performance perspectives” (Kaplan and Norton 1996, p. viii). To achieve such equilibrium, it is necessary to combine several different indicators into a single framework (Daft 2010, p. 77), and the BSC enables exactly that. The BSC can therefore be viewed as a holistic system that may encompass all (or at least the most important) stakeholders of the company, simultaneously providing strategic reflection and implementation (Mooraj et al. 1999; Ittner et al. 2003; De Geuser et al. 2009; Cheffi et al. 2010).

Considering the importance of aligning different measurements with strategy to ensure a holistic view of the organization, we introduce the concept of Balanced Index for the Balanced Scorecard (BSC BI). Kaplan and Norton (1996, p. 34) report that “the four perspectives of the Balanced Scorecard have been found to be robust across a wide variety of companies and industries”. Subsequent papers adapt this framework to various sectors of activity, settings and cultural environments. Nevertheless, the concept of ‘balance’ embedded in the label of the system has not been analyzed in depth. We suggest revisiting Kaplan and Norton’s suggestion that the instrument itself needs to be balanced. The stronger the balance, the higher the scores in each perspective because all perspectives are influencing each other according to the proposed model. Stefanovska and Soklevski (2014, p. 165) go even further, claiming that a BSC “provides equilibrium between multiple perspectives that will enable the organization to develop equally all of its organizational capacities”. In the next section we propose a procedure to capture this equilibrium or balance among the four perspectives. Below we propose the following five sub-hypotheses (based on Olsson et al. 2000; Osama 2006; Funck 2007; Stefanovska and Soklevski 2014; Shin et al. 2015):

H3a: Higher levels of ‘BSC BI’ are positively related to higher levels of ‘learning and growth’ perspective.

H3b: Higher levels of ‘BSC BI’ are positively related to higher levels of ‘internal business processes’ perspective.

H3c: Higher levels of ‘BSC BI’ are positively related to higher levels of ‘customers’ perspective.

H3d: Higher levels of ‘BSC BI’ are positively related to higher levels of ‘financial’ perspective.

H3e: Higher levels of ‘BSC BI’ are positively related to higher levels of ‘strategy implementation’ perspective.

The main hypothesis underlying these five sub-hypotheses is that the more balanced the BSC, the higher the levels of the four perspectives and strategy implementation.

2.4. Research model

The model in Figure 1 summarizes the twelve sub-hypotheses. The solid lines show the three sub-hypotheses testing consistency of the model with the literature (Taticchi et al. 2010; Lueg and Carvalho e Silva 2013; Janeš 2014), whereas the dotted lines correspond to the second and third sets of sub-hypotheses assessing the impact of strategy and the degree of balance of the BSC on the four perspectives. As aforementioned, the first set of hypotheses provides a fresh view on an issue extensively analyzed in the literature and it is represented in solid lines in Figure 1, while the second and third sets of hypotheses are new analysis, and scarcely previous literature exists (mainly for the last set) and are shown in doted lines, meaning that this is an exploratory ground.

Figure 1. Research model showing the relationship between the BSC and the BI BSC.

3. A balanced BSC

Measuring organizational effectiveness using the BSC is a comprehensive and universally accepted method. One critical weakness of this method is that it utilizes operational measures that are unique to each organization (Carton and Hofer 2006, p. 42). Therefore, difficulties occur in attempting to measure the effectiveness of different organizations with the same criteria (i.e., indicators). Given that the systematic and precise measurement of organizational effectiveness through a full application of BSC is a complex, lengthy and expensive process, we propose a method for measuring overall organizational effectiveness in a simplified way using 25 of the most common generic indicators of organizational effectiveness. Selecting five KPIs per perspective is not far removed from what Kaplan and Norton (1996) use. Salterio (2012) uses between four and seven measures for each perspective. Based on these defined weighted indicators, a measure of the effectiveness of each organization is calculated as the sum of all indicators.

In the proposed method, we obtain information on organizational effectiveness through different sources, depending on the specific indicator. We collect data on organizational effectiveness through interviews with top management, a purpose-made questionnaire, and an analysis of publicly available financial reports. The assumption is that data collected in this way provide a real and complete picture of organizational effectiveness.

This method relies on the BSC approach (Kaplan and Norton 1996). Based on the analysis of a number of studies proposing common/generic KPIs, performance indicators are selected for each BSC perspective. These indicators are listed below in Table 1, along with references justifying the inclusion of each of the 25 chosen universal KPIs.

Perspective | Generic indicators | References | ||||||||||

Kaplan and Norton (1996) | Bryant et al. (2004) | Nair (2004) | Niven (2006) | Hannabarger et al. (2007) | Porporato et al. (2008) | Huang et al. (2009) | Hubbard (2009) | Pineno (2009) | Thanaraksakul and Phruksaphnrat (2009) | |||

Financial | F1. Income growth rate | The average revenue growth rate on an annual basis reduced by the amount of financial and extraordinary income. | + | + | + | + | + | + | + | + | ||

F2. Net profit margin | The ratio of profitability calculated as net profit (after tax) divided by total revenues. | + | + | + | + | + | + | + | ||||

F3. Business efficiency | The ratio between total revenues and total expenses, i.e., between outcomes and costs. | + | + | + | + | + | + | + | + | |||

F4. Return on investment | The percentage of net profit (after tax) from investment undertaken to achieve this profit. | + | + | + | + | + | + | + | + | + | + | |

F5. Credit rating | General term for the criteria or benchmarks determining the ability of the borrower to repay a loan, i.e., creditworthiness. | + | + | |||||||||

Customers | C1. Market share | The proportion of business in a given market (in terms of numbers of customers, earned money, or unit volume sold) that an organization captures. | + | + | + | + | + | + | + | + | + | + |

C2. Customer satisfaction | Customer opinion about the organization or its products/services, based on a comparison of the perceived features with their own expectations. | + | + | + | + | + | + | + | ||||

C3. Customer retention | The rate at which an organization retains or maintains ongoing relationships with its customers. | + | + | + | + | + | + | |||||

C4. New customer acquisition | The rate at which an organization attracts or wins new customers or business. | + | + | + | + | + | + | |||||

C5. Customer relationship | Planned and sustained effort to establish and maintain good relations and mutual understanding between an organization and its customers. | + | + | + | ||||||||

Internal business processes | P1. Quality of products/services | The ability of a product or service to meet or exceed customers’ expectations. | + | + | + | + | ||||||

P2. New product introductions | New product implies changing or adding usefulness and/or a new way of using existing products, as well as the introduction of a completely new product. | + | + | + | + | + | + | |||||

P3. Level of capacity use | The ratio between the achieved output and working capacity. | + | + | |||||||||

P4. Work productivity | The ratio between the realized amount (of products) and the amount of human labor required to realize it. | + | + | + | + | + | + | + | ||||

P5. Response time | The time elapsed from when the customer sent a request (inquiry, order, complaint, etc.) until that request has been successfully solved. | + | + | + | + | + | + | |||||

Learning and growth | L1. Employee satisfaction | Employee’s attitude toward work that significantly affects work motivation, and even the employee’s life as a whole. | + | + | + | + | + | + | ||||

L2. Employee productivity | Outcome measure of the aggregate impact of enhancing employee skills and morale, fostering innovation, improving internal processes, and satisfying customers, thereby relating the output produced by employees to the number of employees used to produce that output. | + | + | + | + | + | + | |||||

L3. Information systems capabilities | Measure that indicates if an organization’s information systems support key business processes and enable collection and comparison of relevant business information. | + | + | + | ||||||||

L4. Continuous improvement of processes | The extent to which an organization continuously improves its equipment, methods, materials, and especially its business processes. | + | + | + | + | + | + | + | + | |||

L5. Education and training of employees | The extent to which an organization continuously improves the knowledge and skills of their employees. | + | + | + | + | + | ||||||

Strategy | S1. Precise business objectives | The extent to which business goals are clearly and precisely defined, as well as aligned across different levels of management. | (Strategic indicators are selected and developed based on Batstone 2003; Moullin 2004; Nair 2004; Niven 2006; Hannabarger 2007; Hubbard 2009; Thanaraksakul and Phruksaphanrat 2009; Hill and Jones 2010; Parmenter 2010; David 2011; Hitt et al. 2011; Wheelen and Hunger 2012, as well as on experiences from contemporary business practice) | |||||||||

S2. Mission achievement | The extent to which an organization achieves its mission (primary purpose), i.e., has generated conditions to achieve it within the planned period. | |||||||||||

S3. Business transparency | The extent to which insight into a company’s business operations is provided not only to shareholders and employees but also to the general public. | |||||||||||

S4. Environmental protection | The extent to which environmental protection is an indispensable part of the company’s business policy. | |||||||||||

S5. Concern for the community | The extent to which an organization thinks of itself as part of a wider community, including a wide range of activities, from developing a sense of social responsibility, to active contribution in the development of civil society and advancing the public good. | |||||||||||

Table 1. Selected generic indicators of organizational effectiveness distributed among the BSC perspectives and key references

A study conducted by Soderberg et al. (2011) shows that the term ‘balanced scorecard’ is usually interpreted in different ways among managers and other organizational members, thus resulting in inconsistent definition and implementation of the PMS, which often diverges significantly from the construct envisioned by Kaplan and Norton (1996). This is the main reason it makes sense to define a set of generic performance indicators for key business perspectives. Such an approach implies that all five business perspectives (strategic included) are equally important, but within them the importance and significance of individual KPIs can vary from company to company. An analysis of the generic indicators listed in Table 1 highlights some of their common features as follows: widespread across industries and countries, generic, unique, universal, easy to collect (from employee surveys, manager interviews, and available data from open sources), intuitive, and reliable from a psychometric point of view.

Given that we are comparing the effectiveness of organizations that differ based on a number of criteria (e.g., size, core business, etc.), only relative indicators are used to measure effectiveness. Unlike absolute indicators, which represent specific values expressed in the original measurement units (e.g., value of stocks, total revenue, number of complaints, etc.), relative indicators are derived from absolute indicators by calculation.

Organizational effectiveness has already been defined as the degree to which an organization achieves its goals. However because each organization defines its own specific objectives, not all effectiveness indicators are equally important for all organizations. Therefore, after evaluating indicators within a particular BSC perspective, these indicators are ranked according to the strength of their influence within that same perspective, separately for each organization. This is done such that each perspective establishes one square matrix containing all effectiveness indicators of the observed perspective in its columns and rows. Cells of this matrix indicate relationships between two different indicators. Table 2 shows a comparison of the selected effectiveness indicators using the financial perspective as an example. This table also shows how to calculate the strength of each indicator as required in Table 3.

Effectiveness indicators | F-1 | F-2 | F-3 | F-4 | F-5 |

F-1. Income growth rate | – | F-2 | F-1 | F-4 | F-5 |

F-2. Net profit margin | – | – | F-2 | F-2 | F-2 |

F-3. Business efficiency | – | – | – | F-4 | F-5 |

F-4. Return on investment | – | – | – | – | F-4 |

F-5. Credit rating | – | – | – | – | – |

Number of cells with the indicator F-i | 1 | 4 | 0 | 3 | 2 |

Ranking of the indicator F-i | 4 | 1 | 5 | 2 | 3 |

Strength of indicator F-i | 2/15 | 5/15 | 1/15 | 4/15 | 3/15 |

Table 2. Example of determining the importance of effectiveness indicators within a particular BSC perspective (the financial perspective)

Indicators of financial perspective | Indicator assessment (1 – 5) | Weight (strength of) indicator | Weighted indicator score |

Income growth rate | 3 | 2/15 | 0.400 |

Net profit margin | 4 | 5/15 | 0.667 |

Business efficiency | 2 | 1/15 | 0.333 |

Return on investment | 5 | 4/15 | 1.067 |

Credit rating | 2 | 3/15 | 0.400 |

Total weighted score for the perspective: | 2.867 | ||

Table 3. Example of determining the weighted score of the financial perspective

The ultimate goal of this method for measuring overall organizational effectiveness is to calculate the Index of organizational effectiveness (IOE), a measure that expresses the effectiveness of a particular organization by taking into consideration indicators of key BSC perspectives. In doing so, these indicators are ranked according to their importance for the particular organization for which the measure is calculated. In other words, once the weighted indicator scores for each of the five perspectives are determined, these scores must be summed, and then divided by the total number of perspectives. The quotient obtained, as shown in the example in Table 4, is the Index of organizational effectiveness of a particular organization.

Perspective | Total weighted score for the perspective | | (Total weighted score for the perspective) – IOE) | |

Financial | 2.867 | 0.353 |

Customers | 4.032 | 0.812 |

Internal business processes | 2.230 | 0.990 |

Learning and growth | 3.275 | 0.055 |

Strategic | 3.694 | 0.474 |

The total sum of all BSC perspectives: | 16.098 | 2.684 |

| Index of Organizational Effectiveness (IOE): 16.098/5 = 3.220 | BSC Balanced 2.684/5 = 0.537 |

Table 4. Example of how to calculate the Index of organizational effectiveness (IOE) and the Balanced Index for the Balanced Scorecard (BSC BI)

Associated to IOE, Table 4 also calculates the ‘Balanced Index’ that captures the degree of imbalance among BSC perspectives (BSC BI). The most ‘balanced’ BSC is that in which the five perspectives are assessed with the same punctuation, which yields a BSC BI of zero.

4. Methodology and results

A questionnaire was designed to collect the required information and was completed by 874 respondents from 24 different companies in the Republic of Croatia in 2014. The survey includes companies from 6 different counties, out of 21 counties in Croatia. The number of employees in surveyed companies varies between 216 and 1100, with an average of 513. The companies vary widely by sector—from different types of manufacturing to building and construction, design, consulting and research, insurance, publishing, telecommunications, television programming and broadcasting, warehousing and transportation logistics, wholesale and retail, and wholesale of pharmaceutical goods. After examining all completed questionnaires, a total of 813 valid responses are obtained. The sample shows a gender bias, as 485 respondents are women. Two thirds of respondents are under 44 years old, and more than half have been serving at their company less than ten years.

The six variables of the model are computed as explained in previous sections. Table 5 shows the descriptive statistics of the variables. The first five variables range from one to five, whereas the last (BSC BI) is calculated as explained in the previous section.

Correlation matrix | ||||||

1 | 2 | 3 | 4 | 5 | 6 | |

1 Financial | 1.000 | |||||

2 Customers | 0.467 | 1.000 | ||||

3 Internal business processes | 0.378 | 0.449 | 1.000 | |||

4 Learning and growth | 0.505 | 0.425 | 0.629 | 1.000 | ||

5 Strategic | 0.591 | 0.534 | 0.625 | 0.687 | 1.000 | |

6 BSC BI | -0.668 | -0.268 | -0.276 | -0.198 | -0.241 | 1.000 |

Mean | 3.268 | 3.816 | 3.605 | 3.707 | 3.856 | 0.343 |

Standard deviation | 0.916 | 0.573 | 0.484 | 0.576 | 0.536 | 0.316 |

Table 5. Statistics of the variables

Path analysis using EQS software is chosen to analyze the regressions implied in the research model. The structural model is estimated by using the maximum likelihood method from the asymptotic variance–covariance matrix.

The fit indices obtained in the measurement model estimation show good general fit. χ2 is 47.42 with 3 degrees of freedom and a p-value of 0.000. RMSEA is 0.135, and the comparative fit index (CFI) is 0.979. All sub-hypotheses are confirmed at a confidence level of 95% (Table 6), with the exception of H3a, thus providing sufficient evidence to accept the three main hypotheses.

Hypothesis | Path coefficient (standardized solution) | t-value | |

H1a | Learning and growth → Internal business processes | 0.370 (*) | 10.252 |

H1b | Internal business processes → Customers | 0.163 (*) | 3.993 |

H1c | Customers → Financial | 0.106 (*) | 5.173 |

H2a | Strategy → Learning and growth | 0.679 (*) | 28.130 |

H2b | Strategy → Internal business processes | 0.342 (*) | 8.476 |

H2c | Strategy → Customers | 0.402 (*) | 10.521 |

H2d | Strategy → Financial | 0.403 (*) | 17.938 |

H3a | BSC BI→ Learning and growth | -0.035 | -1.224 |

H3b | BSC BI→ Internal business processes | -0.120 (*) | -4.209 |

H3c | BSC BI→ Customers | -0.126 (*) | -3.354 |

H3d | BSC BI→ Financial | -0.524 (*) | -28.493 |

H3e | BSC BI→ Strategy | -0.241 (*) | -7.322 |

(*) Significant at 5% level

Table 6. Hypotheses results for the structural model

The three sub-hypotheses H1 are confirmed, providing evidence that the impact flow among the four perspectives is consistent with the literature, showing homological validity.

The four sub-hypotheses H2 are also confirmed, suggesting that strategy deployment has a positive impact on each of the perspectives. Note that the higher paths of the model are those that show the impact of the ‘strategy’ construct on the four perspectives, in accordance with Kaplan and Norton (1996) and Atkinson (2006).

Finally, four out of the five sub-hypotheses H3 are also confirmed, giving support to our last proposition: the more balanced the BSC among the four perspectives, the higher the score organizations obtain in the four perspectives, as well as in the strategy construct. Note the negative sign in these paths because the lower the BSC BI index, the more balanced the scorecard.

5. Discussion and conclusions

We have proposed a BSC simple enough to be used by any organization, no matter its size or resources available to monitor it. The results of this study not only confirm assumptions about causal relationships implicit in the BSC model as suggested by previous studies (e.g., Nørreklit 2000; Bryant et al. 2004) but also suggest that even a simplified and balanced BSC behaves in the same way as the original BSC. The balanced BSC proves consistent with previous literature in terms of the relationship among its perspectives, proving its homological internal consistency. Furthermore, this measurement system is based in only 25 KPIs that are easily collected because most organizations use them as part of regular management. This also enables benchmarking across organizations, making comparisons feasible and consistent. Moreover, this makes the proposed model particularly interesting for SMEs. Needless to say the managerial implications derived from this simplified BSC for SME. These organizations are neither able to devote resources to define a complex SME nor to monitorize it. The proposed BSC enables not only implementing and monitorizing it, but also the analysis and improving proposals, influencing the entire Plan-Do-Check-Act Deming cycle.

It is also well established that the BSC “provides a framework, a language, to communicate mission and strategy” (Kaplan and Norton 1996, p. 25). However, business practice shows that some key elements of strategy are often not measured in the BSC. Today, organizations must pay attention to environmental protection and concern for the community, as well as business transparency. These are just some examples of KPIs that are not represented in the standard BSC perspectives. In this paper we explain the importance of embedding strategy in BSC design, and hypothesis testing unambiguously indicates that higher levels of ‘strategy implementation’ are positively related to all four standard BSC perspectives.

Another contribution of this paper, perhaps the most important, is to introduce the measurement of the ‘balance’ or ‘equilibrium’ of the four perspectives, through the Balanced Index for the Balanced Scorecard (BSC BI). This study shows that higher levels of BSC BI are positively related to higher levels of almost all key BSC perspectives (except for the learning and growth perspective). These results strongly indicate the need for balancing different business perspectives, which should be evident at all levels of the company from setting goals to balancing organizational values. Our findings are consistent with those of Kaplan and Norton (1996), who claim that “the four perspectives of the BSC have been found to be robust across a wide variety of companies and industries”. In addition, the four perspectives should display equivalent scores to show harmonious strategy deployment.

Finally, some limitations of the study should be noted. The first limitation relates to the sample, which was restricted to Croatian companies. Future studies should be conducted with larger samples and should cover a wider geographical area. Moreover, the adequacy to different activity sectors could also be addressed in future, and also the fit of the model to different size companies. Another limitation concerns the fact that the BSC is actually a management system for improving organizational performance (Kaplan and Norton 1996, p. ix), whereas in this study, BSC was primarily used as a technique for capturing/measuring the current state of organizational effectiveness.

References

Amado, C. A., Santos, S. P., & Marques, P. M. (2012) ‘Integrating the Data Envelopment Analysis and the Balanced Scorecard approaches for enhanced performance assessment’, Omega, 40(3), 390-403.

Atkinson, H. (2006) ‘Strategy Implementation: A Role for the Balanced Scorecard?’, Management Decision, 44(10), 1441–1460.

Batstone, D. (2003) Saving the Corporate Soul – & (Who Knows?) Maybe Your Own: Eight Principles for Creating and Preserving Wealth and Well-Being for You and Your Company Without Selling Out, John Wiley & Sons: San Francisco, CA.

Bryant, L., Jones, D.A., Widener, S.K. (2004) ‘Managing Value Creation within the Firm: An Examination of Multiple Performance Measures’, Journal of Management Accounting Research, 16(1), 107–131.

Carton, R.B., Hofer, C.W. (2006) Measuring Organizational Performance: Metrics for Entrepreneurship and Strategic Management Research, Edward Elgar Publishing: Cheltenham.

Celma, D., Buil, M., Patau, J. (2017) ‘Management control in startups with high growth success in the Technology sector: The case of Netrivals’, European Accounting and Management Review, 3(2), 17-44.

Cheffi, W., Rao, A., Beldi, A. (2010) ‘Designing a Performance Measurement System: Accountants and Managers Diverge’, Management Accounting Quarterly, 11(3), 8–21.

Čizmić, E., Crnkić, K. (2010) ‘Enhancing Organizational Effectiveness and Efficiency through Balanced Scorecard Application’, Problems and Perspectives in Management, 8(4), 14–26.

Daft, R.L. (2010) Organization Theory and Design, 10th ed, South-Western Cengage Learning: Mason, OH.

David, F.R. (2011) Strategic Management: Concepts and Cases, 13th ed, Prentice Hall: Upper Saddle River, NJ.

Epstein, M.J., Manzoni, J.-F. (1997) ‘The Balanced Scorecard and Tableau de Bord: A Global Perspective on Translating Strategy into Action’, Management Accounting, 79(2), 28–36.

Funck, E. (2007) ‘The Balanced Scorecard Equates Interests in Healthcare Organizations’, Journal of Accounting & Organizational Change, 3(2), 88–103.

De Geuser, F., Mooraj, S., Oyon, D. (2009) ‘Does the Balanced Scorecard Add Value? Empirical Evidence on its Effect on Performance’, European Accounting Review, 18(1), 93–122.

Hannabarger, C. (2007) Balanced Scorecard Strategy for Dummies, Wiley Publishing: Hoboken, NJ.

Hill, C.W.L., Jones, G.R. (2010) Strategic Management Theory: An Integrated Approach, 9th ed, South-Western/Cengage Learning: Mason, OH.

Hitt, M.A., Ireland, R.D., Hoskisson, R.E. (2011) Strategic Management Concepts: Competitiveness and Globalization, 9th ed, South-Western Cengage Learning: Australia ; Mason, OH.

Hoque, Z. (2014). ‘20 years of studies on the balanced scorecard: trends, accomplishments, gaps and opportunities for future research’, The British accounting review, 46(1), 33-59.

Huang, H.-C., Chu, W., Lai, M.-C., Lin, L.-H. (2009) ‘Strategic Linkage Process and Value-Driven System: A Dynamic Analysis of High-Tech Firms in a Newly-Industrialized Country’, Expert Systems with Applications, 36(2), 3965–3974.

Hubbard, G. (2009) ‘Measuring Organizational Performance: Beyond the Triple Bottom Line’, Business Strategy and the Environment, 18(3), 177–191.

Hurtado González, J.M., Calderón, M.Á., Galán González, J.L. (2012) ‘The Alignment of Managers’ Mental Models with the Balanced Scorecard Strategy Map’, Total Quality Management & Business Excellence, 23(5-6), 613–628.

Ittner, C.D., Larcker, D.F., Randall, T. (2003) ‘Performance Implications of Strategic Performance Measurement in Financial Services Firms’, Accounting, Organizations and Society, 28(7-8), 715–741.

Janeš, A. (2014) ‘Empirical Verification of the Balanced Scorecard’, Industrial Management & Data Systems, 114(2), 203–219.

Kaplan, R.S., Norton, D.P. (1992) ‘The Balanced Scorecard – Measures That Drive Performance’, Harvard Business Review, 70(1), 71–79.

Kaplan, R.S., Norton, D.P. (1996) The Balanced Scorecard: Translating Strategy into Action, Harvard Business School Press: Boston, MA.

Kasurinen, T. (2002) ‘Exploring Management Accounting Change: The Case of Balanced Scorecard Implementation’, Management Accounting Research, 13(3), 323–343.

Kumbakara, N. (2008) ‘Managed IT Services: The Role of IT Standards’, Information Management & Computer Security, 16(4), 336–359.

Lueg, R., Carvalho e Silva, A.L. (2013) ‘When One Size does not Fit All: A Literature Review on the Modifications of the Balanced Scorecard’, Problems and Perspectives in Management, 11(3), 86–94.

Martinsons, M., Davison, R., Tse, D. (1999) ‘The Balanced Scorecard: A Foundation for the Strategic Management of Information Systems’, Decision Support Systems, 25(1), 71–88.

Mooraj, S., Oyon, D., Hostettler, D. (1999) ‘The Balanced Scorecard: A Necessary Good or an Unnecessary Evil’, European Management Journal, 17(5), 481–491.

Morisawa, T., Kurosaki, H. (2003) ‘Using the Balanced Scorecard in Reforming Corporate Management Systems’, Nomura Research Institute Papers, (71), 1–15.

Moullin, M. (2004) ‘Evaluating a Health Service Taskforce’, International Journal of Health Care Quality Assurance, 17(5), 248–257.

Nair, M. (2004) Essentials of Balanced Scorecard, Essentials series, John Wiley & Sons: Hoboken, NJ.

Nanni, A.J., Dixon, J.R., Vollmann, T.E. (1992) ‘Integrated Performance Measurement: Management Accounting to Support the New Manufacturing Realities’, Journal of Management Accounting Research, 4, 1–19.

Niven, P.R. (2006) Balanced Scorecard Step-by-Step: Maximizing Performance and Maintaining Results, 2nd ed, John Wiley & Sons: Hoboken, NJ.

Nørreklit, H. (2000) ‘The Balance on the Balanced Scorecard a Critical Analysis of Some of Its Assumptions’, Management Accounting Research, 11(1), 65–88.

Olsson, B., Karlsson, M., Sharma, E. (2000) ‘Towards a Theory of Implementing the Balance Scorecard: A Study in Association with the Swedish Telecommunication Firm Ericsson’, Journal of Human Resource Costing & Accounting, 5(1), 59–84.

Osama, A. (2006) Multi-Attribute Strategy and Performance Architectures in R&D: The Case of The Balanced Scorecard, PhD Thesis.

Parmenter, D. (2010) Key Performance Indicators: Developing, Implementing, and Using Winning KPIs, 2nd ed, John Wiley & Sons: Hoboken, NJ.

Pineno, C.J. (2009) ‘Simulation of the Weighting of Balanced Scorecard Metrics Based on the Product Life Cycle’, The Coastal Business Journal, 8(1), 85–100.

Porporato, M., Basabe, M., Arellano, J. (2008) ‘Commonality and Standardization of Balanced Scorecard’s Measures across Perspectivas’, Revista del instituto internacional de costos, (2), 113–131.

Rodrigues Quesado, P., Frenandes Branco, J. C., Rodrigues, F. J. (2017) ‘Proposal to Implement the Balanced Scorecard in a Non-profit Organization’, European Accounting and Management Review, 4(1), 49-74.

Salterio, S. (2012) ‘Balancing the Scorecard through Academic Accounting Research: Opportunity Lost?’, Journal of Accounting & Organizational Change, 8(4), 458–474.

Shin, J., Choi, J., Kim, I. (2015) ‘Development of BIM Performance Measurement System for Architectural Design Firms’, in Celani, G., Sperling, D.M. and Franco, J.M.S., eds., Computer-Aided Architectural Design Futures. The Next City – New Technologies and the Future of the Built Environment, Springer Berlin Heidelberg: Berlin, Heidelberg, 348–365.

Soderberg, M., Kalagnanam, S., Sheehan, N.T., Vaidyanathan, G. (2011) ‘When is a Balanced Scorecard a Balanced Scorecard?’, International Journal of Productivity and Performance Management, 60(7), 688–708.

Stefanovska, L., Soklevski, T. (2014) ‘Benefits of Using Balanced Scorecard in Strategic and Operational Planning’, Universal Journal of Management, 2(4), 165–171.

Taticchi, P., Tonelli, F., Cagnazzo, L. (2010) ‘Performance Measurement and Management: A Literature Review and a Research Agenda’, Measuring Business Excellence, 14(1), 4–18.

Thanaraksakul, W., Phruksaphanrat, B. (2009) ‘Supplier Evaluation Framework Based on Balanced Scorecard with Integrated Corporate Social Responsibility Perspective’, in Proceedings of the International MultiConference of Engineers and Computer Scientists (Vol II), Presented at the IMECS 2009, Hong Kong.

Wade, D., Recardo, R. (2001) Corporate Performance Management: How to Build a Better Organization Through Measurement-Driven Strategic Alignment, Butterworth-Heinemann: Woburn, MA

Wheelen, T.L., Hunger, J.D. (2012) Strategic Management and Business Policy: Toward Global Sustainability, 13th ed, Pearson Prentice Hall: Upper Saddle River, NJ.